The Chicago real estate market continued to demonstrate it's incredible strength in April with home sales up 32.5% over the previous April. That's on top of last April's 19.4% increase and it's the 22nd month in a row of year over year home sale increases, confirming yet again that the Chicago real estate market is super hot.

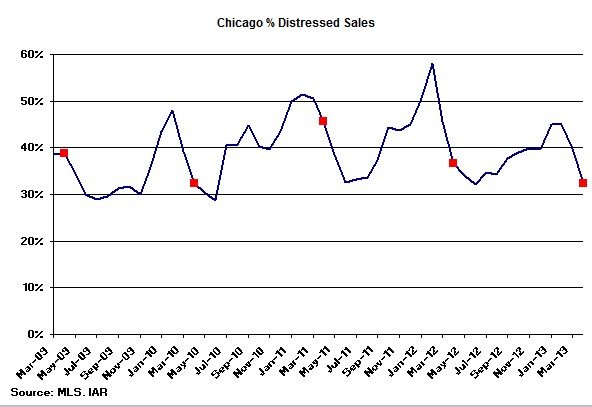

In keeping with my usual caveat...when the Illinois Association of Realtors reports these numbers in 2 weeks they will be understating it as a 27.8% increase because they will be comparing preliminary 2013 numbers to final 2012 numbers for April. In addition you can expect them to make much ado about the increase in median prices, which hit at least a 2 year high of $221,700 or 21.8% above last year's $182,000. Just a reminder that this doesn't really mean much. It's certainly not an indication of the overall level of prices but rather an indication that the mix of homes sold is skewing decidedly upward. As I get into below there are far fewer distressed property sales than there have been in the past.

April Chicago Home Sales

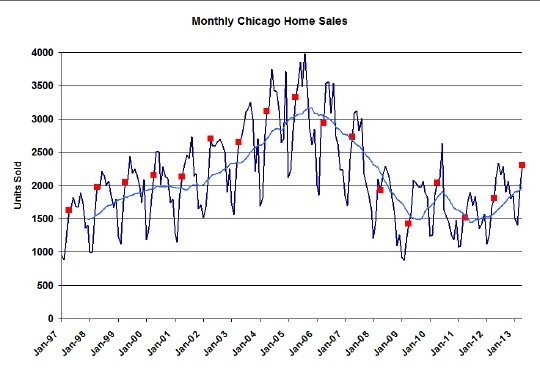

When you look at the long term graph of Chicago home sales by month below you can see that this April was the highest in 6 years. Furthermore, you will note that this is a level higher than that of 2001, which was actually the beginning of the housing bubble. On the one hand I would not expect us to hit the bubble levels any time soon unless we began another bubble. On the other hand though there is probably a lot of pent up demand sitting out there so we might still see some further increases over the next 12 months.

Chicago Home Contract Activity

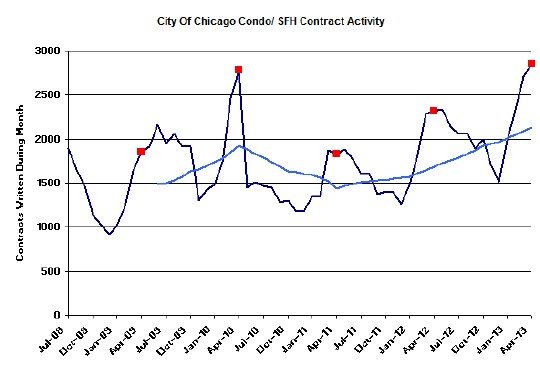

Contract activity, which is a leading indicator of home sales, continues to point in an extremely positive direction. I don't have that data as far back but as you can see in the graph below this April had the strongest contract activity in 5 years. This April was 22.6% above last year and the moving average, in blue below, continues to move upward.In general the growth in contract activity has been stronger than the growth in closings but every so often the backlog of pending home sales clears and results in surges like we just saw in April. Right now pending home sales is sitting at 7011, which is just a tad over a 3 month supply at April's sales rate.

Distressed Home Sales

As I alluded to above the percentage of distressed home sales in Chicago has been trending downward. April hit the lowest level in 5 years, edging out 2010 by just a hair at 32.3%. This is what is driving the median price higher, not an overall increase in prices, though that is a contributing factor as well.

Chicago Home Inventory

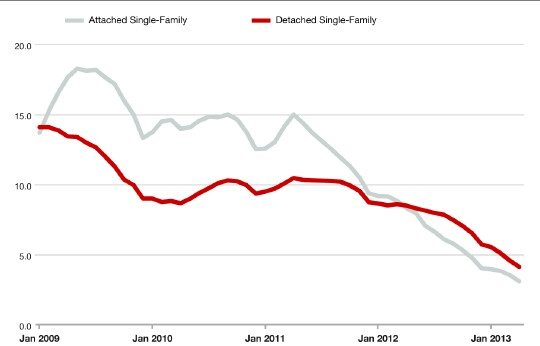

There is still a critical shortage of good home inventory in Chicago, making it extremely difficult for buyers to find anything decent. However, as you might expect, sellers and their agents are in great shape with properties selling in record times. Some listing agents are making a killing these days so keep that in mind when negotiating the selling commission (it is negotiable).From a high of 14.1 months back in January 2009 single family home inventory has dropped to 4.1 months in April. Meanwhile condo inventories, which peaked at 18.3 months, have now plummeted to a 3.1 month supply. And it just keeps on dropping.

If you want to keep up to date on the Chicago real estate market, get an insider's view of the seamy underbelly of the real estate industry, or you just think I'm the next Kurt Vonnegut you can Subscribe to Getting Real by Email.

Filed under: Foreclosures/ Short Sales, Market conditions

Tags: Chicago home sales, Chicago real estate market, market conditions

Tags: Chicago home sales, Chicago real estate market, market conditions

No comments:

Post a Comment